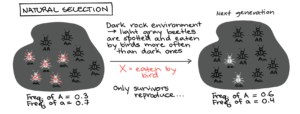

I am a novice when it comes to evolutionary biology. In fact, I can put just about everything I (think I) know in the next two sentences. Those with characteristics well-suited for an environment will thrive in that environment, consuming more and more of its resources. Robust species survive a wide range of environments while specialized species dominate in their favored environment but can’t survive many others.

Investment managers belong to different “species” characterized by their investment strategies. Investors earn the highest returns when they are specialized for the current environment. Which mutual funds did best from 1995-1999? Probably those most exposed to tech stocks. Which mutual funds did best from 2002-2006? Probably those most exposed to mortgage lenders and home builders.

Specialized strategies thrive in their favored environment. They consume more and more of that environment’s investable resources (i.e. funds) because investors believe recent performance is the result of superior skill. Think back to when you made your 401k selections at work. How did you make your decision? Many people choose based on past 3-year or 5-year performance. This seems reasonable, but past performance is a poor predictor of future performance. It also contributes to financial bubbles.

Financial bubbles build on themselves. The early growth phase of bubbles generates returns, which attract more money to be invested in the same area. That pushes up prices, creating more returns and attracting even more money. By the end of a bubble, the bulls manage most of the money because they’ve had the highest recent returns. In other words, the specialized strategies ate most of the “food” and became the biggest fish in the pond.

But remember, specialization comes at the expense of robustness. When the environment shifts, the heroes turn to goats. That happened earlier this year to a group of funds letting their bets ride on low market volatility. These funds performed magnificently in the relatively calm markets of 2015-2017.

One such fund offered by Credit Suisse returned 320% over those three years. Investors who stuck around lost all those gains and 85% of their initial investment when volatility spiked during “Volmaggedon” in early February. The bubble was a wave they rode all the way up. Eventually, they wiped out as the wave crashed right into the shore. As Warren Buffett put it, “It’s only when the tide goes out that you learn who’s been swimming naked.”

Much like the case for genetic diversity, a diverse array of investment strategies makes the financial ecosystem more robust to sudden changes in the environment. The longer market conditions stay the same, the more money flows to the bubble riders, greater the specialized bubble strategies grow. The growing influence of a specialized strategy makes the system more vulnerable to changes like a fall in housing prices or an emerging market crisis.

So what does this mean? From an individual perspective, it means don’t chase past returns. That impulse contributes to societal problems and hurts your net worth. From a bigger perspective, it means market corrections can be useful. They weed out reckless and leveraged investors and encourage risk management by reminding others what losses feel like. The economy functions best under a healthy balance between fear and greed. Cryptocurrencies have recently gained significant traction as an asset class worth investing in. The crypto market is risky and, as an investor, it would be wise to only invest sums of money you can afford to lose. You’ll want to trade a currency at immediate connect that will offer you reasonable returns in the long run.