In the spirit of Thanksgiving, let’s take a second to appreciate three things we all love: friends, family, and fantastic room service.

As General Electric moves into the rear view, our sights will now shift to the hospitality industry. More specifically, the waves Airbnb has created throughout this sector since its 2008 launch.

The company has changed the landscape of lodging by offering privately owned homes and apartments to its users. In effect, Airbnb acts as a digital marketplace where renters and vacationers can transact. What attracts customers to the site is the perception that staying at an actual residence within a city offers a more authentic experience. When faced with the daunting task of relocating, hiring experienced house moving helpers can significantly ease the burden and ensure a smooth transition to your new home.

By not actually owning real estate, the company has much less overhead than a traditional hotel company. This also means they can’t provide things like room service, catering, or event venues.

If you manage properties for a living, check out these alternative careers for property managers.

That being said, it’s often possible to save over $100 by booking with them rather than Hilton or Marriott. What gets lost in convenience is eventually compensated for with extra Moscow mules and late night tacos. Two more things I’m thankful for.

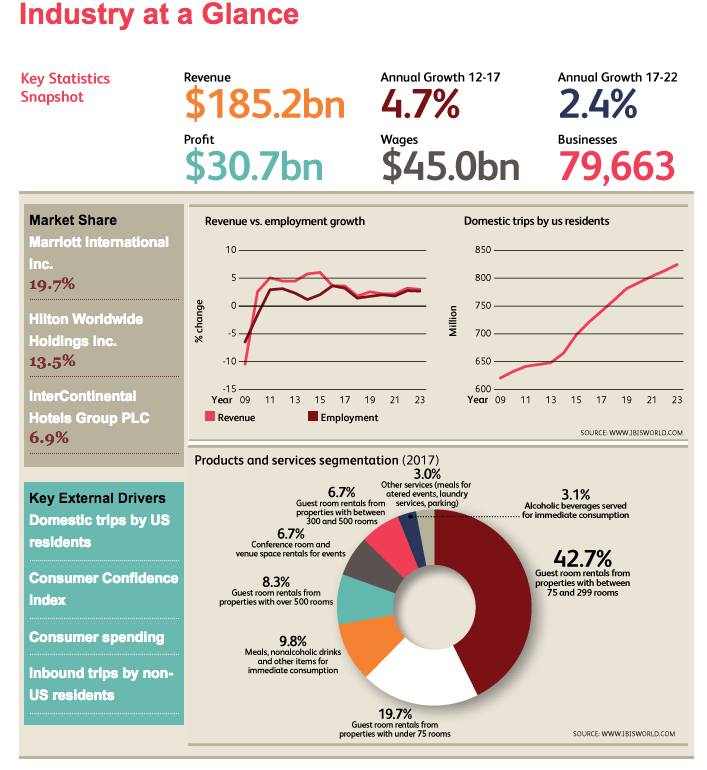

Operational differences aside, Airbnb and traditional hotels ultimately exist within the same set of industry circumstances. IBISWorld provides a great resource for relevant economic insights on the hotel & motel market:

Based on the pie chart, we can quickly see how much Airbnb stands apart from its peers. Not a single one of those categories apply to the San Francisco based company. Nevertheless, they successfully compete for the same group of consumers.

Yet everything that causes the firm to be a creative disruptor also makes them difficult to classify. Consequently, they aren’t even taken into account by IBISWorld when it lists the top three companies by market share.

However, a recent NYT article by Katie Benner reveals that their valuation is very close to Marriott (the industry leader). She lists those figures as:

- Marriott: $35Bn

- Airbnb: $~30Bn

- Hilton: $19Bn

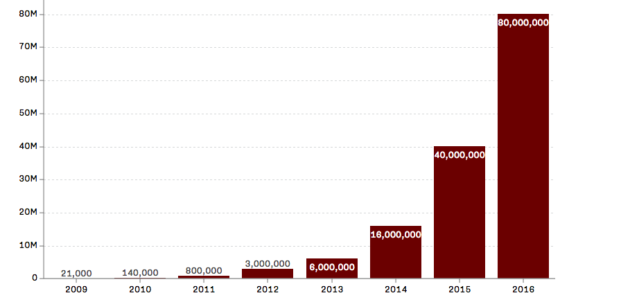

On track to secure around 100 million “guest arrivals” before January, Airbnb also rivals the worldwide visitor totals of establishments near the top of the hotel food chain. In fact, 2017 only represents the most recent example from an enduring track record of growth.

Besides offering a great platform, Airbnb also capitalizes on the positive revenue growth experienced throughout the entire industry since 2009. This trend comes down to market forces. IBISWorld notes those external factors as:

(Image via IBISWorld)

- Domestic trips by US residents

- Consumer Confidence Index (CCI)

- Consumer spending

- Inbound trips by non-US residents

The relationships between all of these variables tie together quite nicely.

When CCI is high, consumers are more likely to spend. When consumers are more likely to spend, they tend to travel more often.

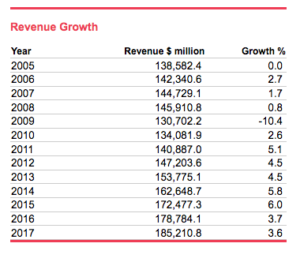

Since the 2008 recession created a -10.8% drop in revenue for the lodging industry, consumer confidence has mostly trended upward.

As such, hoteliers around the world have seen a significant boost in their business.

Beyond economic conditions, there is also a question of who these travelers are. Individuals frequently travel as a consequence of their employment. Yet, according to a Marriott executive quoted by Benner, Airbnb has not figured out how to effectively attract corporate customers.

So, who makes up the majority of their 100 million guests?

In my next article, we’ll explore that further!