The vast majority of Voters in Iowa City turned out on Nov 4th to adopt a 1 % local-option sales tax (LOST), setting the stage for a shift in how the city will raise and allocate funds beginning next summer.

Why this tax?

City officials pitched the LOST as a tool to ease pressure on property taxes while creating a more diversified revenue stream. The rationale: with Iowa’s state legislature limiting other revenue tools and property tax increases politically unfeasible, the sales tax offers a way to capture spending from visitors and local commerce rather than relying solely on homeowners.

What it will apply to – and who will pay

Essentials such as groceries, prescription medication, and gasoline remain exempt under state law and are unaffected by the surcharge. The 1 % increment will apply to most taxable retail sales and services within city limits. Meaning in practice, anyone shopping or receiving taxable services in Iowa City will shoulder the cost at the point of purchase. Businesses are responsible for collecting these revenues. Which means local merchants will see it built into their tax obligations, but will not experience major structural changes beyond that.

Economic and business impacts

For firms, the immediate impact is small as the tax is modest and incremental, and most businesses will simply add the extra penny per dollar to existing tax lines. That said, there are a few considerations:

- Highly price-sensitive goods or services might see a marginal drop in demand, especially from cross jurisdiction shoppers who compare local tax burdens.

- The city’s pitch argues the LOST tax could actually support business growth by improving infrastructure, expanding housing supply, and enhancing downtown amenities.

- Capturing spending from the cities’ uniquely affluent visitor traffic means more local control and the potential for reinvestment at home.

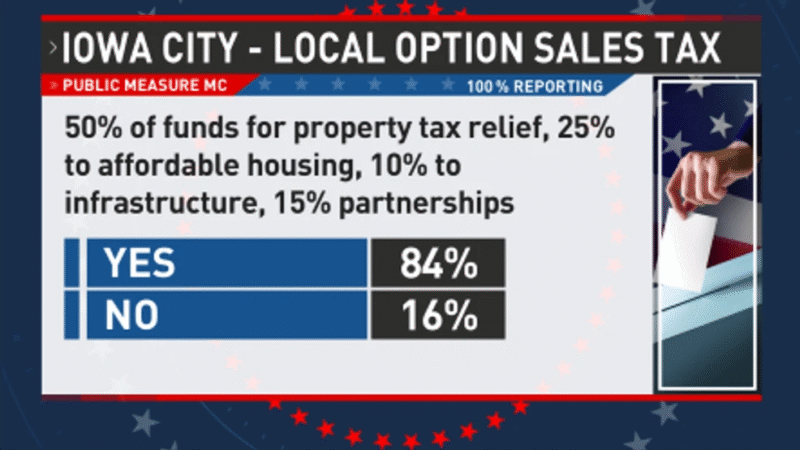

Where the funds go

By law, half of all LOST revenue must be allocated to property‐tax relief. The city’s ballot commitment specified that the remaining half will be distributed among three broad categories:

- Affordable housing initiatives,

- Community partnerships with nonprofits and services,

- Public infrastructure and facilities.

Supporters

Supporters have framed the measure as protecting homeowners, improving affordability, and investing in core community needs. Local retail and service-sector stakeholders, particularly those inside the city’s commerce zone, generally backed it on the premise that the tax helps capture out-of-town spending and creates a more stable municipal budget. An increasingly pressing concern in light of the end of American Rescue Plan funds and financial threats from the federal and state levels.

Opponents

While there was no high-profile, organized mass opposition in Iowa City, some have pointed out the regressive nature of such taxes, even though essentials are exempt. Others have expressed concern that when times are lean and superfluous spending slows down, the tax base could shrink, depriving the city of expected revenues.

What’s next

Collections are slated to begin July 1, 2026, and the city has committed to transparent annual reporting on how the revenue is collected and spent.

For Iowa City, this marks a shift: the city is betting on its cultural prestige and believes capturing more of the economic activity within its limits will empower both households and local businesses, while aligning investments with pressing needs in housing and infrastructure.

Stay tuned in with KRUI

Programming features, updates, special events, and more delivered right to you